The Corporacion Minera de Bolivia (Comibol) and the Triangular Plan: A Case Study in Dependency

Melvin Burke

CITATION INFORMATION

Burke, Melvin, Latin American Issues [On-line], 4.

Available: https://sites.allegheny.edu/latinamericanstudies/latin-american-issues/volume-4/

ABOUT THE AUTHOR

Melvin Burke is Professor of Economics at the University of Maine, Orono. He has done extensive research on and in Bolivia where he has worked for USAID and CORDE-PAZ, and has been a Rutgers Exchange Professor at the Universidad Mayor de San Andres in La Paz. He has written numerous scholarly pieces on that country; perhaps his best known work on Bolivia is his 1972 Estudios criticos sobre la economia bolivana. More recently, he has been a Fulbright Visiting Scholar in Mexico. His present research centers upon the debt crisis throughout Latin America.

This monograph studies the nationalized mining corporation of Bolivia (COMIBOL) and the Triangular Plan, a $62 million financial assistance program intended to rehabilitate the Corporation over the ten year period 1960-1970. The failure of this program constitutes a classic example of dependency. Many of Bolivia’s contemporary social, financial, and economic problems can be traced to this program and its failures.

I have long been concerned with this subject. I began the research of this study in 1968 while employed by the Agency for International Development in La Paz, Bolivia. A draft manuscript was written in 1972 while serving as the visiting professor (Rutgers University) at San Andres University. My return to Bolivia in the summer of 1982, funded by a small grant from the Inter-American Foundation, convinced me that the unfinished manuscript should be completed and made available to scholars and decision-makers in the U.S. and Bolivia.

I thank all these institutions for their support in the project and the many individuals who made it possible. Foremost among these is my wife, June Burke, who served as research assistant and typist. This monograph is dedicated to the progressive people of Bolivia and the the miners and their families.

– Melvin Burke

This monograph is a study of a nationalized industry in an underdeveloped country. The geographical setting is Latin America and the specific case study is that of Corporacion Minera de Bolivia, better known as COMIBOL. The intent of the study is to evaluate the Triangular Plan, a $62 million financial assistance program funded 1961 to 1970 by the Inter-American Development Bank and the governments of West Germany and the United States. After less than a decade of existence (1952-1960), COMIBOL was decapitalized, de facto bankrupt, and on the verge of collapse. The objective of the Triangular Plan was to rehabilitate the Corporation through financial and technical assistance combined with internal operational reforms. Unfortunately, there have been no comprehensive studies of this program until now. Hence, we have been unable to see if there was a need for the Triangular Plan in the first place, if the program was a success in recapitalizing and rehabilitating COMIBOL, and what were the major costs and benefits that accompanied the plan.

This study provides some answers to the above questions. The answers may not please individuals of widely divergent ideological persuasions. On the one hand we shall see that nationalization was not the panacea envisioned by Bolivian nationalists and revolutionaries. On the other, neither Bolivian private enterprise nor the Triangular Plan turned out to be the unlimited sources of investment funds, the bearers of advanced technology, or the engines of growth envisioned by many at the time. Bolivia is a model example of the failure of revolution and nationalization to liberate an underdeveloped country from dependency on mono production, on foreign finance, and on external dominance in general. Nationalization, like political independence, did not liberate the nation economically. Dependency, if it has changed at all since colonial times, has only become more subtle and disguised. In this case study of Bolivia and COMIBOL, for instance, we shall see how deceptive accounting was employed to discredit labor and their organizations. The objective of this practice coincided with that of the Triangular Pian itself: to destroy the workers’ unions and denationalize the mining industry of Bolivia while ostensibly rehabilitating the Corporacion Minera de Bolivia. In this endeavor, the foreign creditors and the various military juntas of Bolivia were more than just a little successful. Bolivia’s contemporary foreign debt crisis and its socioeconomic consequences are directly linked to the policies and practices adopted during this program. National bankruptcy in Bolivia, denationalization, and debt dependency are the legacy of the Triangular Plan. The first part of this study reports on the situation in Bolivia and COMIBOL prior to the Triangular Plan. The remainder of the paper is concerned with the specific findings of this study in dependency.

II

COMIBOL BEFORE THE TRIANGULAR PLAN

Bolivian Mining Before 1952

How and why COMIBOL came to be in the first place requires a brief description of Bolivian mining before the 1952 nationalization of the three largest mining companies of Patino, Hochschild, and Aramayo.1 In the decades prior to 1952, these mining firms accounted for approximately 70 percent of all Bolivian mineral exports by value. Under their leadership, the mining industry of Bolivia reached its historic peak in 1929 when it produced 49,191 fine metric tons of tin. By the 1930’s, the established older mines of Bolivia began to encounter decreasing ore grades, increasing ore complexity, and greater inaccessibility of ores. Consequently, they experienced a drop in mine labor productivity, mill recovery, and tin export concentrates. All this gave rise to increasing costs of production immediately prior to World War II, precisely when world prices for minerals were at record lows.

By 1940, the prices of minerals had recovered and this greatly improved the revenue earnings of the mines. Nonetheless, profitability was hampered by the high and increasing costs of production. Even the favorable mineral prices of World War II failed to attract the investment needed to decrease the cost of mining and processing Bolivian ore. The excellent Ford, Bacon, and Davis study (1956) found “no record of widespread investment in Bolivian mining” from 1932 to 1951. The report also found no evidence of major investments in the crucial area of scientific mineral exploration.

Previous to nationalization none of the three major companies (Big Three) had made much progress toward any significant outside exploration work in the modern sense of scientific applications. They had been acquiring properties mainly by examination and purchase of small properties of prospect.2

The so-called “Big Three” were international corporations confronted with investing in what they perceived to be a dying industry in an unstable social setting. The Great Depression, the Chaco War with Paraguay (1932-1935), and World War II had greatly altered the traditional economy and society of Bolivia. The disastrous Chaco War left nothing unchanged in its wake: national boundaries and Bolivian society itself were all radically altered culminating in various political upheavals in the following decade. There were seven presidents and eight coups d’etat between 1911 and 1952. The various governments were all ultimately controlled by the landed elite, mine owners, and others referred to as the “Rosca”. This incipient instability fueled an emerging revolutionary movement advocating “Tierras al Indio” and “Minas al Estado” (Land to the Indian and Mines to the State).

In an environment hardly conducive to long-term private investment, the mining companies substituted labor for capital in an attempt to increase production. This policy ultimately generated even more instability. The ranks of the mine labor force swelled by nearly 50 percent precisely when Bolivian revolutionaries were making a major drive to organize the miners.3 Unionization was vigorously resisted by the large mine operations which tried to maintain wages and working conditions at pre-World War II levels. The consequent radicalization of the mine movement inevitably led to a series of disturbances at the mines, and clashes between the militant mine unions and the strike-breaking Bolivian army were frequent during the decade. Moreover, the post-War II decrease in world demand for minerals forced the Patino mines to lay off thousands of workers, resulting in yet more strikes, layoffs, and violent confrontations. By the late 1940’s, the large private mines of Bolivia were nearly exhausted, decapitalized, unprofitable and riddled with labor strife. In 1948, the general manager of Catavi filed a report in which he stated that the mine would not last “more than four more years at the maximum.4 As the Ford, Bacon, and Davis study put it:

Even before nationalization in 1952 the average grade of ore from many of the mines had decreased to the marginal limit, and some of the old mines had actually closed down because of the combined effects of the above and the adverse economic factors presented by taxes, labor, and world mineral prices.5

Bolivian mining before 1952 thus presents a classic case study of Andre Gunder Frank’s “development of underdevelopment.”6 From the exploitation of silver mines in colonial Potosi to that of tin mines in Catavi, Bolivia exported her mineral wealth, made a few individuals such as Patino multimillionaires, and became relatively and absolutely underdeveloped in the process. Political independence in the 1800’s did not alter the substructure of economic dependency at all. On the contrary, much as Frank pointed out, the greater Bolivia’s ties were with the multinational corporate world and their financial-industrial center, the greater was their rate of underdevelopment. In a similar fashion, those who worked these mines were as impoverished–or more so–as laborers employed elsewhere in the economy, a condition exacerbated by mine accidents, lung diseases, and premature deaths. In no small way, then, was dependent underdevelopment a major contributor to the 1952 revolution and to the subsequent nationalization of the “Big Three” mining companies of Bolivia. Moreover, because the Corporacion Minera de Bolivia inherited many of its problems from the former private owners, the latter also share responsibility for the poor economic performance of COMIBOL during its early years.

Nationalization of the Mines

In 1951, the Movimiento Nacionalista Revolucionario (MNR), a new “middle-class” reform party, failed to muster an absolute majority of votes in the national election and subsequently formed a coalition with the embryonic labor movement. On April 11, 1952, after three days of street fighting in the capital city of La Paz, the MNR-labor coalition, joined by the National Military Police, seized political power. The miners played a most significant role in the uprising as “soldiers of the revolution” that would radically alter the economic, social, and political structure of Bolivia. The new MNR government decreed universal adult suffrage for all Bolivian citizens, put into practice various labor and social reforms, and proceeded to redistribute the lands of the latifundios (large landed estates) to the former Indian laborers.

One of the most significant acts of the new government was the expropriation, by Supreme Decree No. 3223 on October 31, 1952, of the mining companies of Patino Mines and Enterprises Consolidated, Inc., Mauricio Hochschild Sociedad Anonima Minera Industrial, and Compania Aramayo de Minas en Bolivia. The MNR government justified this decision in the nationalization decree:

Whereas:

The large enterprises, without taking into consideration the paramount interests of the nation, subordinated the national efforts to the exclusive exploitation of their mines until converting Bolivia into a simple mining camp;

By not returning to the nation the full value of the mineral exported, the three large enterprises produced a permanent drain of the exhaustible mineral wealth of the nation;

This constant capital flight gave rise to the progressive impoverishment of the nation and annulled the possibility of creating and developing an internal market;

The system of work imposed by the large mining companies is so inhuman and oppressive that the life of the interior miner is barely 27 years;

The national victory of April, the culmination of a long historic process, has made possible the realization of the irrevocable decision of the Bolivian people;

Decreed:

To nationalize, for the national welfare, the mines of Patino, Hochschild and Aramayo.

These mining properties were placed under the control of the Corporacion Minera de Bolivia, an autonomous public corporation established previously by Supreme Decree No. 3196 on October 2, 1952. Approximately 163 mines and mineral properties were nationalized as well as railroads, electrical plants, and other properties. The initial capital of the corporation was established at $34,500,000 by Supreme Decree No. 3869 on November 8, 1954. This was the value of the former private mining companies that appeared on their balance sheets at the time of expropriation.7

COMIBOL thus became the largest single enterprise, principal mineral producer, and major exporter of Bolivia. Its revenues at the time were greater than that of the central government, and it earned more than half of the nation’s foreign exchange. As such, it constituted the major base industry of Bolivia upon which the transport, construction, and trading activities depended for much of their business. Moreover, the Corporation provided schools, hospitals, pulperias (company stores) and other services for its employees and their dependents. Henceforth, the prosperity and growth of the Bolivian economy was intimately linked to that of COMIBOL.

COMIBOL Profits and Losses to 1960

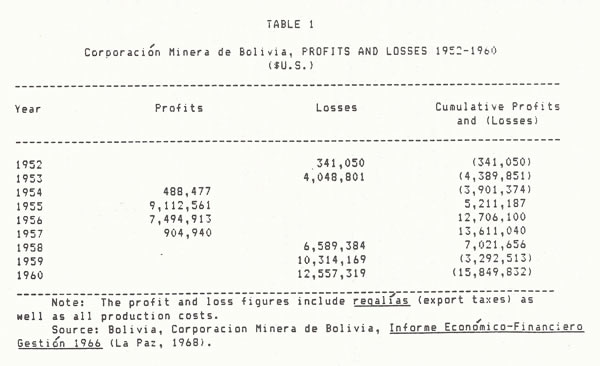

Yet the economic performance of this huge public enterprise during its first decade of existence was, by every conceivable standard, dismal. Tin production declined from 27,347 metric tons in 1952 to 15,230 tons in 1960. In addition, production of all other minerals with the exception of bismuth decreased during this period. This decrease in physical output was also accompanied by accounting losses as seen in Table 1.

Bolivia’s hyperinflation, multiple exchange rates, and foreign exchange controls of these early revolutionary years caused havoc throughout the mining industry and the economy in general. Indeed, the financial data provided in Table 1 for the years 1952-1956 do not tell the whole story. COMIBOL, for example, claims to have paid the central government over $100 million in hidden taxes during the years 1952-1956. The corporation had been required by law to sell all foreign exchange earnings to the Central Bank for as much as 3,500 Bolivianos (Bs.) to the $U.S. 1.00 and purchase foreign exchange at a rate of Bs. 190 to the $U.S. 1.00. While the multiple exchange rate appeared to be in the Corporation’s favor, the fact was that COMIBOL sold a great deal more foreign exchange than it purchased. Moreover, the free (black) market rate of exchange by 1956 had fallen to Bs. 12,000 to $U.S. 1.00 and inflation had risen by more than 1500 percent since 1952.8 In other words, COMIBOL’s small purchases of foreign exchange at the subsidized official rate did not compensate for the inflated losses incurred from huge sales of the same.

The Corporation’s accounting losses after 1957 in Table 1 are also misleading in yet another way. COMIBOL books include regalias (export taxes) totaling $11,558,106 that in fact were never paid to the central government. Supreme Decree No. 5729 of March 1961, cancelled regalias owned by COMIBOL for the years 1957-1959. However, it is also true that when these uncollected taxes are subtracted from the cumulative loss figure, COMIBOL still lost money during the period. And one thing is obvious: COMIBOL was not a highly productive or profitable enterprise during its early years. As the Ford, Bacon, and Davis study stated:

Losses during 1959 are expected to be in the order of $10,000,000, including accrued interests, buffer stock retention, and indemnization payments to former owners. These losses do not include provision for amortization, indemnization and bad debt reserves, nor provision for the amortization of various debts, unpaid taxes, and interests owed to Government agencies, nor necessary provision for accelerated development and exploration. Including these factors, Corporation losses might be as high as $15,000,000 to $20,000,000 annually.9

A significant part of COMIBOL’s losses during this period were due to the decline in world mineral prices that began in 1953 (Appendix Table 4). Bolivia’s internal market absorbed only three percent of domestic mineral production and the rest was exported in the form of concentrates. Although COMIBOL could do little to alter the negative effect of these decreased prices upon its revenue earnings between 1952 and 1960, the impact of these lower prices on profitability was devastating. COMIBOL lost approximately $500,000 in revenue for every one cent decrease in the price of tin. Between 1952 and I954, the world price of tin decreased by 29 cents (Appendix Table 1). COMIBOL’s decrease in total revenue in these formative years was therefore a combination of decreases in mineral prices as well as decreases in output.

Labor, Control Obrero, and Productivity

The reader should not be left with the impression that all of the problems of the Corporation were beyond its control. Indeed, to fully understand the need for external financing under the Triangular Plan and to comprehend its successes as well as its failures, the performance of COMIBOL during these formative years must be examined in greater detail. Indeed the Ford, Bacon, and Davis study found that “the technical problems are surmountable, within reasonable limits, but the real problems facing the industry are those of a human nature,”10 an allusion to workers’ share in the management of COMIBOL. The Federacion Sindical de Trabajadores Mineros de Bolivia (FSTMB) had demanded and obtained extensive power in the day-to-day decision-making of the Corporation with the establishment of control obrero (workers’ control) by Supreme Decree No. 3586 in December of 1953. Under this provision, two of the seven directors of COMIBOL and one member of the management team at each mine were elected and designated representatives of labor. Their function was to represent the miners in matters affecting working conditions, welfare, and personnel problems. Although the control obrerospossessed veto authority in these areas, they were explicitly prohibited from interfering in the technical decisions of management.

Almost immediately, the powerful workers’ groups raised money wages, increased social benefits, and altered working conditions in the miners’ favor. In addition, several thousand unemployed miners returned to work and were welcomed by labor leaders intent upon increasing their political strength. COMIBOL’s work force increased from 28,973 employees in 1952 to a record high of 36,558 in 1956 (Appendix Table 6). Many of these returning miners were too old for interior work and were therefore employed above ground. By 1961, two-thirds of COMIBOL’s miners were employed above ground, a situation exactly the reverse of that found in most other mines outside Bolivia where two-thirds of the work force was typically employed underground.

In addition to increasing employment and raising money wages, the union and workers’ control groups made every effort to improve the health and education of the miners and their dependents. The number of students receiving education at the Corporation mines, for example, increased from 6,416 in 1952 to 30,356 in 1960.11

Despite such achievements, the situation of labor was not much better than before. It was estimated “that the rapid inflation from 1950 to 1955 decreased the miners’ total direct and indirect wage benefits . . . by about 60 percent.”12 Mine doctors claimed that half of COMIBOL’s workers had some type of respiratory ailment such as tuberculosis or silicosis in 1956. Five to eight percent of the workers were incapacitated, while 15 to 20 percent were on the sick list at any given time. The average age of a miner was between 22 and 24 years old with a life expectancy of 27 or 33 years depending upon whether he worked above or below the surface. The turnover of workers averaged 20 percent per year, and the miner could expect a work life of just 6 to 8 years.13 It would appear that the workers’ benefits were more political than economic as the COMIBOL miners remained as unhealthy, untrained, and thus unproductive as they were prior to the 1952 Revolution.

In light of control obrero, the great increase in employment, and abysmal working conditions, it is not surprising that the belief that labor alone was responsible for the ills of the Corporation began to gain wide public acceptance in 1960 when the Bolivian government began to shop in the capitals of the world for credits with which to rehabilitate the mines. A major propaganda campaign in the La Paz newspapers contributed to spreading what later became dogma.14 Labor was also singled out by the various official studies of Bolivian mining as the one factor most responsible for COMIBOL’s poor economic performance. In a capitalistic system, labor is always the root cause of all the financial and economic problems of the system or firm while capital and management take the credit for productivity, profits, and prosperity. COMIBOL was to be no exception.

This blatant ideological bias, however, becomes transparent to even the most casual observer. For one thing, by comparison with private mines in Bolivia, COMIBOL was remarkably successful in maintaining physical productivity at the mines during this period. According to the Ford, Bacon, and Davis study:

The private industry employs from 25,000 to 30,000 men approximately the same number as the nationalized mines, but accounts for only 25 to 35 percent of the gross (official) value of mineral production.15

As we shall see, just as the miners’ money wage increases were more than offset by hyperinflation during these years, so was their physical productivity lost in the pricing and milling processes. In theory and in fact, production and profitability are functions of prices, land, labor, capital, management, and technology together. Each shares responsibility for the unproductive and unprofitable early performance of COMIBOL. COMIBOL management, like management everywhere, was responsible for the technological and economic efficiency of the firm or its lack. Prior to nationalization, many managers and most of the technical staff of the Corporation were foreigners. After nationalization, nearly all of the approximately 200 foreign technicians left the country rather than work for a public enterprise. Consequently,COMIBOL began operations with a dearth of engineers, managers, and other technical and administrative personnel. This condition, moreover, prevailed throughout the following decade. As early as 1958, Ford, Bacon, and Davis reported that:

It is the opinion of the Engineers that the requisite management and technical staff, for reasonable operation of Corporation mines, no longer exist.16

Moreover, because a nationalized industry requires unique labor-management relations generally incomprehensible to those trained in or for private industry, the complex early labor situation of the Corporation was badly handled. The managers were indecisive and confused since they could not manage COMIBOL as a private company and were apparently incapable or unwilling to adjust to the changed reality. They, along with the unions, tended to view labor-management problems as class conflicts just as they did before nationalization. Since labor was initially powerful, management abdicated a great deal of legitimate authority. Finally, although the evidence is inconclusive, there apparently existed some management featherbedding. Administrative costs rose to the point where “the portion of administrative cost to sales was in the order of 7 percent where, in the normal metal business, we would expect it to be from one to two percent.17

Decapitalization of COMIBOL

Decapitalization was yet another legacy of COMIBOL’s predecessors. It appears that the survival of the Corporacion Minera de Bolivia was attained only by continuing the policy of (lecapitalization begun earlier by its former owners. COMIBOL, in these formative years, did not replace worn-out plant and equipment, and continued to deplete its ore reserves and inventories. While this policy mitigated rising costs in the short run, it further decapitalized the mines and adversely affected productivity, output, costs, and profits. Without exception, every report on Bolivian mining at the time including the Ford, Bacon, and Davis, the Huston, and the Salzgitter studies elaborated upon time capital deficient situation at the COMIBOL mines.18 In a sentence, the Corporation’s installations, machinery, and other equipment were obsolete, lacked maintenance, and were underutilized. The Huston study estimated that the largest mills operated at only 50 percent of capacity during the years 1958-1960.19 At least in part, this was the result of a chronic lack of replacement parts and supplies. Due to the remoteness of Bolivian mines, a six month to one year’s inventory of parts and supplies is considered time minimum for continual operation. While this initially required a large investment in inventory, it also enabled COMIBOL to draw down these stocks to the point where the mining operations were adversely affected. Many of the work stoppages and strikes at the mines prior to the Triangular Plan can be attributed to this practice. Both the miners and the engineers frequently petitioned the central office to redress what they considered an impossible situation–mineral production without adequate equipment and spare parts.20 Their pleas went unanswered because COMIBOL, for all practical purposes, was de facto bankrupt at the same time.

Why did the Bolivian government permit such a deterioration of its public mines? One reason lies in the fact that COMIBOL, a public enterprise created in a revolutionary setting, did not have access to the private financial markets of the world. Secondly, the MNR government chose to invest borrowed funds in regional diversification, in highway construction (Santa Cruz-Cochabamba), and in education. Thirdly, scarce foreign exchange earnings and loans were also needed to feed the population during the chaotic early years of the revolution. The agrarian reform disrupted Bolivian agriculture to such an extent that virtually the entire domestic consumption of wheat flour had to be imported by 1954 at a cost of millions.21 Finally, as pointed out before, the government policy was to take from COMIBOL. If we accept the Corporation’s claim that over $100 million was paid to the central government in hidden taxes, then juxtapose this to the reported cumulative accounting losses of nearly $16 million, COMIBOL’s early decapitalization becomes imminently comprehensible. Ford, Bacon, and Davis went so far as to claim that “no other government in the Western Hemisphere takes so much from the mining industry as Bolivia.”22 Thomas E. Burke, in this study of Bolivian mining, had this to say on the subject:

As a result of the MNR policy, gross investments for 1952-1956 did not exceed $8.5 million out of a gross sales approximated at $164.0 million. This was considerably less than the $8.0-$10.0 million per year believed necessary merely to keep an enterprise the size of COMIBOL in operation.23

Were all this not enough, there exists ample evidence of COMIBOL’s decapitalization in the form of depletion of ore reserves and a failure to invest in exploration. This too was a counter-productive practice learned from Patino, Aramayo, and Hochschild:

COMIBOL (and its predecessors) has been depleting its ore reserves with little action toward locating replacements. With the exception of Santa Fe in 1930 and San Jose de Ayata in 1950, no new discoveries of any significant size have been made in the last 35 years.24

Although there exists no estimate of the amount COMIBOL spent on locating new ore reserves from 1952 to 1960, it is clear that the Corporation did not spend five percent of gross revenue on exploration, a standard considered by experts to be the minimum necessary. Indeed, the Corporacion Minera de Bolivia probably did not spend this sum on investments of all types during the period.

Disinvestment in exploration necessitated the utilization of lower grade ores which contributed to higher costs of production, a situation we shall examine further below. But it also had an adverse effect upon investment in general. Accurate estimates of ore reserves provide a guide to the life expectancy of mines and therefore the feasibility of long-term investments. It would be extremely hazardous, if not downright foolish, to invest in mine equipment with a life expectancy of say twenty years when the reserve estimates of a mine indicate that the mineral will be depleted after only ten years. In Bolivia, where the mineral extracted has traditionally been of lower grade and increasing complexity, accurate knowledge of reserves is especially important. Yet despite this, the Corporation provided no official estimate of ore reserves before 1957. Moreover, reserve estimates after that date are themselves highly questionable. Ford, Bacon, and Davis reported in 1956 that every COMIBOL tin mine with the exception of Coiquiri had an “indicated life” expectancy of 10 years or less. Six of the mines were reported to have no productive years left and no possibility of increasing reserves. Finally, the quality of the ore at all the mines was becoming increasingly complex, sulfurous, and of lower grade.25 Such pessimistic estimates amid a lack of accurate knowledge did not make for a favorable investment climate.

Technical Efficiency in COMIBOL to 1960

Be that as it may, there is no disputing the fact that COMIBOL’s disinvestment in exploration resulted in higher costs and lower profits. On the technical side, the depletion of ore reserves led to the utilization of lower grade ores which in turn reduced mill recovery and lowered the grade of concentrates. Higher production costs, and lower prices, and accounting losses were the financial consequences. Without exception, all the major tin mines of COMIBOL depleted their reserves and processed increasingly lower grades of ore during the years 1950-1960. Catavi, Huanuni, and Colquiri, which produced more than half of the Corporation’s tin output, suffered decreases of nearly 50 percent in milihead grades (Appendix Table 7). It is not uncommon in similar mining operations to improve the technical efficiency at the milling and smelting stages to compensate for declining ore grades.

To COMIBOL’s credit, it must be admitted that it did attempt to improve technological efficiency by experimenting with a chemical process (flotation) that treats slimes and tailings. Preconcentration plants were also improved and new gravity tables were installed in the mills. Unfortunately, the financial condition of the firm during its first ten years of operation precluded many optimum investments of this type. The declining millhead grades thus became the first link in a vicious chain reaction at the technical level followed by a decline in the mill recovery rates of fine tin. Lower millhead grades and mill recovery rates, ceteris panbus, increased the cost of producing a fine ton of tin–COMIBOL’s major mineral export. The Catavi mine alone experienced a decrease in its millhead grade from 1.28 to .73 percent between 1950 and 1960 (Appendix Table 7). In addition, Catavi’s mill recovery also decreased during the period from 69.2 to 50.1 percent (Appendix Table 8).

With the exception of only one mill, that of Santa Fe, recovery rates at COMIBOL tin mills decreased during this period (Appendix Table 8). It is, nevertheless, significant that the decline in the grade of ore mined was greater than the decrease in mill recuperation. While COMIBOL was not successful in completely compensating for its disinvestment in exploration, it did mitigate somewhat the damage at the milling stage.

In conclusion, the poor technical and economic performance of the Corporacion Minera de Bolivia before the Triangular Plan was the result of a multitude of complex interrelated factors not susceptible to simple explanations. There is more than enough blame to go around for the firm’s near collapse during its formative years, including the former private owners of the mines, international creditors, the MNR government, and COMIBOL management as well as labor. Each contributed its share to the Corporation’s increasing cost of production. The previous owners of the mines, however, set the stage for the disaster by disinvesting in what they perceived to be a dying industry.26 In 1952, Bolivia was a classic example of a dependent monoproduction economy resembling nothing so much as a giant mining camp subordinate to the world market for minerals for its very existence. As such, it suffered and continues to suffer all the negative aspects of excessive international specialization, including worsening terms of trade.27Monoproduction was yet another legacy of Patino, Aramayo, and Hochschild. All this caused problems for the post-revolutionary government. In 1952, 97.5 percent of Bolivia’s total exports were minerals and this percentage only decreased to 89.7 two decades later (Appendix Table 1). Even the belated International Tin Agreement failed to retard a fall in price of COMIBOL’s major mineral export. Consequently, COMIBOL’s revenues declined accordingly. In the end, this situation culminated in accounting losses for the Corporation of nearly $16 million for the years 1952-1960. Subtracting $11 million in unpaid regalias (taxes) still leaves the bottom line in the red. When depleted inventories, non-funded amortization, and ore depletion are added to all this, there can be little doubt that the Corporacion Minera de Bolivia was de facto bankrupt as well as decapitalized by 1960.

In March 1961, the government of the United States, the government of West Germany, and the Inter-American Development Bank formed a consortium to rehabilitate COMIBOL by providing the technical and financial assistance recommended by the bank’s Huston study and requested by the government of Bolivia. The Inter-American Development Bank, the coordinator of the program, also provided the technical advisors. Thus did a unique experience in international lending known as the Triangular Plan come into existence.

The irony here, as we shall see later, is that this bankruptcy and decapitalization is but the first instance of disguised profitability on the part of COMIBOL. If COMIBOL did pay the Bolivian government $100 million in hidden taxes as it is reputed to have done, then it was actually a profitable public enterprise which simply never had access to the surplus it generated. It seems that public corporations cannot reveal profits since this would expose the myth of public enterprise inefficiency as well as raise the issue of distribution. Everyone, the workers, the state, suppliers, consumers, etc. can legitimately lay claim to such public enterprise surplus. This is one aspect of nationalization which has not been resolved in Bolivia to this day. We shall have more to say on this subject as our investigation progresses.

III

THE TRIANGULAR PLAN: COMIBOL PROFITS AND LOSSES

The Program: Facts and Figures

By 1960, the collapse of the COMIBOL was imminent. The Ford, Bacon, and Davis study in 1959 went so far as to predict that “by 1970, under present conditions, Bolivia will be an unimportant mineral producer.”28 In less than a decade, from 1952 to 1960, Bolivian tin production as a percentage of the world total decreased from 18.7 percent to 12.1 percent (Appendix Table 1). Because mining was the major base industry of Bolivia, COMIBOL’s poor economic performance constituted a drain upon the financial and the real economic resources of the entire economy. The nation’s other nationalized industries, such as petroleum and the railroads, were not fully reimbursed for services rendered to COMIBOL. Even the universities, which depended upon the Corporation for revenues, were incurring budget deficits during the period. The alarmed Bolivian public and other interested parties agreed that the situation had deteriorated to the point where the nation was trapped in a vicious circle from which it was incapable of extricating itself without outside help. To this end, Dr. Guillermo Bedregal Gutierrez, the president of COMIBOL, spent the summer of 1960 visiting foreign capitals of the world for financial and technical assistance.29

The Triangular Plan formally began with the signing of the original Memorandum of Understanding in June of l96l.30 According to this document, the stated purpose of the operation was to bring about the rehabilitation of COMIBOL with inputs of capital and technical assistance combined with organizational reforms, particularly in the area of labor-management relations. Although originally conceived as a three-year operation, the Triangular Plan evolved into a three phase, ten-year operation when it became obvious that the initial funds and time were totally inadequate for the task. The Corporacion Minera de Bolivia received about $62 million in both foreign and domestic currency loans during the ten years of the Triangular Plan.31 This capital assistance was equal to twice the original net worth of the Corporation and three times the total compensation paid to the former private owners of the mines. Roughly two-thirds of the loans were granted in foreign currencies and the remainder in Bolivian pesos generated from the domestic sales of title 1, FL 480 wheat flour.32 An interest rate of 4 percent was attached to the dollar loans and 1 percent to 3 percent to the peso loans. The sources, amounts, and uses of the Triangular Plan funds are summarized in Table 3.

Of this $62 million of assistance, more than $36 million or 60 percent was used for the purchase of equipment and spare parts and for the restocking of depleted warehouses. Nearly this entire amount was disbursed during the first two phases of time Program. Only 6 percent of these funds, or less than $4 million, was allocated to exploration mostly during the last phase of the operation. Less than $1 million, or 2 percent of the assistance, was expended on metallurgical research. Less than 7 percent of the Triangular Plan funds were used in the layoff programs to be discussed below. It is worth noting that while the total assistance disbursed in Phase I and Phase II was equal to that recommended by the Huston and Salzgitter studies, labor force reduction and mineral exploration were the only two programs which received less than one-third the recommended amount.33Explanations for these particular allocations will be offered as the study progresses.

Accounting vs. Actual Profits and Losses (1961-70)

Initial expectations were frustrated when the $50 million of assistance expended during the first two phases of the operation failed to generate anticipated profits. During these five years, COMIBOL reported cumulative accounting losses of nearly $46 million. Beginning in 1966 with Phase III, the firm began earning profits and continued to do so throughout the remaining four years of the program. Despite this turnaround, the records show nearly $37 million of cumulative accounting losses during the decade of the Triangular Plan (Figure 1).

Before too much credence is accorded these figures, however, it is again necessary to warn the reader that they are misleading. Economics may be the dismal science, but accounting often resembles a black art. Nowhere, perhaps, was “creative accounting” put to more use than in COMIBOL during the Triangular Plan. It appears that the Corporation overstated and understated actual profits and losses at will.34 For instance, it was able to finance $37 million of cumulative losses by listing on its books more than $50 million in regalias which were never collected by the Bolivian Treasury. Supreme Decree No. 6413 of March, 1963, cancelled regalias owed for the years 1960-1964 with the stipulation that these amounts be credited to COMIBOL as a capital contribution from the government. Supreme Decree No. 7474 of January, 1966, extended this procedure through 1966. Supreme Decree No. 7849 of November, 30 percent of regalias owed during the years 1967-1971.

The story of how profits were reported as losses is revealing. In late 1964, while Bolivia was negotiating for a third phrase of the Triangular Plan, the continued unprofitable performance of COMIBOL was publicly debated in La Paz. For the first time, the citizens of Bolivia were informed by Dr. Bedregal that COMIBOL did not pay regalias to the government.35 Astute newspaper reporters and others quickly surmised that COMIBOL, by the end of 1954, was therefore profitable. Indeed, the statistics do reveal that the Corporation’s reported losses less unpaid regalias for 1964 was actually a $1 million profit (Appendix Table 2). Alarmed officials denied that any surpluses or profits existed. They claimed that COMIBOL, unlike the former private owners of the mines, was obliged to defray the cost of many social services such as health, education, and housing for the miners and their dependents which should have been supported by the government. In addition, they argued that the Corporation helped to finance the country’s major universities and was often called upon to clandestinely liquidate sundry government debts. It was their position that profits did not exist despite the non-payment of regalias and that the Government of Bolivia was indebted to the Corporation rather than vice versa. It must be admitted that it was not a simple task to determine the financial performance of a public corporation the size and complexity of COMIBOL. This unique enterprise produced, bought, and sold a variety of minerals; owned and operated railroads, smelters, and hydroelectric plants; and provided food, shelter, health, and education for its employees. This is not meant to imply, however, that the firm was justified in keeping two sets of books or listing unpaid taxes as costs of production.

Apparently, the Triangular partners concurred with this position of nonprofitability because prior to agreeing to Phase III of the operation they recommended that regalias be lowered and all back taxes owed by the Corporation be considered a capital contribution.36 The Bolivian government, after some hesitation, agreed to these conditions and in December of 1966 engaged in negotiations with the firm to balance the accounts. The Corporation conceded that it owed the various government agencies $57,790,710.24 in back taxes which both parties agreed was $2,471,823.91 less than COMIBOL had paid to the different divisions of the government since the beginning of its operations in 1952. Subsequently, this figure was adjusted to $3,972,052.95 in recognition of COMIBOL’s contribution to the Buffer Stock of the International Tin Council.37 This clearing of accounts continued throughout the remaining years of the Triangular Plan. By the end of 1970, the Bolivian Government still owed the Corporation $2,541,883.89 by this reasoning.38 Although the Corporation was still legally obligated to pay regalias, at lower rates, after a 1965 tax reform,39 there is no record of any such compliance except for a $4 million payment to the treasury in 1966.40

All this information leads to the conclusion that the Corporacion Minera de Bolivia did not pay the government of Bolivia the regalias listed in its books as costs throughout the years of the Triangular Plan operation. Indeed, the inescapable inference to be drawn from such unorthodox bookkeeping is that COMIBOL was actually a profitable enterprise during the 1960’s! Moreover, as seen in Figure 1, the turnaround to financial solvency began in 1963 and not in 1965 as is commonly believed. The firm realized actual profits (accounting losses less unpaid regalias) as early as 1964. COMIBOL profits, excluding unpaid regalias totaled more than $17 million during the Triangular Plan. This figure contrasts sharply with the recorded accounting losses of $37 million. Little credit should be given to the Triangular Plan loans for COMIBOL’s turnaround to profitability. Turnaround was due more to the government’s tax forgiveness which was largely unknown and even less understood at the time. An editorial in a major La Paz newspaper commented at the time that the rehabilitation program should have been called the “Quadrangular Plan.”41 There is more than just a little truth to this observation. In addition to not collecting taxes, the government reduced the regalias leveled by more than 50 percent in 1966. These lower taxes accordingly enabled the firm to report accounting profits during the last phase of the Triangular Plan.

Third Phase Objectives

It was politically expedient that COMIBOL show modest accounting profits before the termination of the Triangular Plan. In no small measure, it was the international lenders who were responsible for a new policy of governmental assistance beyond suspending tax payments. Cognizant of the fact that many of the rising costs during the first two phases of the program were beyond control of the Corporation, they also insisted that the following additional changes be implemented before agreeing to a third phase: (1) suspend reparations to the former private owners of the mines until a fixed indemnification be determined; (2) grant tax exemptions to all Triangular Plan imports; and (3) renegotiate COMIBOL’s debt obligations.42

The Bolivian government was only too willing to comply with the first condition since it had already paid Patino, Aramayo, and Hochschild more than $20 million for their decapitalized properties since 1952, and these payments continued to constitute a drain upon the Corporation’s financial resources. It is highly unlikely that COMIBOL and the government of Bolivia would have paid the former owners $20 million for their properties in the first place had it not been for the Hickenlooper Amendment of the U.S. Foreign Assistance Act which requires compensation for expropriated property as a condition for the continuance of aid. However, because further compensation payments conflicted with Triangular Plan objectives and needs after 1965, they were not continued. Because compensation payments were made from its regalia accounts, the elimination of these obligations also made it easier for the Bolivian government to reduce these export taxes after 1965.

The Bolivian government was less willing to eliminate the import taxes on mine equipment because of the existence of U.S. “tied loans.” These loans severely limited the firm’s ability to purchase machinery, equipment, and spare parts at the lowest prices since half of the Corporation’s foreign loans were subject to the restriction that they be used to purchase U.S. imports. Furthermore, Bolivia was obliged to increase its total imports from the United States by the amount of the dollar loans–a relatively unknown dependency obligation known as “additionality.” The U.S. Agency for International Development in Bolivia, in an interdepartmental memorandum, recognized that such obligation contradicted its mandate:

Another factor is the involvement of USAID, on one hand, in the ‘Triangular agreement’ with the Federal Republic of Germany and the Inter-American Development Bank to cut back COMIBOL’s costs, and on the other hand, its insistence on ‘additionality’ which cannot but raise costs.43

There can be no doubt that in the absence of “tied loans” and “additionality,” the Corporation’s costs of production during the rehabilitation program would have been substantially less. Be that as it may, the policy could not be changed.44

The Bolivian government was not successful in renegotiating the firm’s debts despite the fact that most of the Corporation’s financial obligations resulted from the Triangular Plan loans. Payments on these loans were already becoming major costs of the Corporacion Minera de Bolivia as early as the Third Phase when the first principal payment fell due. When the Triangular Plan ended in 1970, COMIBOL owed $29 million in foreign currency debts with $40 million of principal and interest to be repaid.45 The final payment on these debts was scheduled to fall due in the late 1980’s. It is not just a little ironic that the Corporation was unable to renegotiate its debt obligations and cost reductions with the very parties that recommended such a course of action in the first place.

For dependency theorists, the logic of this situation is most striking. “Tied loans” and “additionality” increased exports from Bolivia’s foreign creditors and perpetuated economic dependency. The refusal of the Triangular Partners to renegotiate the terms of their loans guaranteed continued financial dependency on the part of the Bolivian government which increasingly had to rely upon deficit financing as it reduced mine tariffs and regalias. Herein also lies the origin of an advanced stage of financial dependency known as the “debt trap.”

In response to this inflexibility on the part of their partners, COMIBOL management once again called upon its creative accountants to compensate for the increased financial costs. Whereas interest obligations were fixed and externally obligated, depreciation charges were flexible and internally controlled. The accountants did not hesitate to take full advantage of this situation. During the ten years of the Triangular Plan, the firm’s fixed capital increased by $27 million, yet its accounting records show virtually no change in annual depreciation charges.46 Thus we have yet another example of unique accounting, the end product of which was higher recorded profits as explained by Thomas Burke:

COMIBOL applies depreciation rates given by the Bolivian tax authorities but the tax rates are not related to the useful life of the assets; however most of the empresas, for instance, depreciated machinery and installations over 20 years instead of ten years as provided by the tax regulations. Much of the machinery amortized over 20 years has a much shorter, useful life; for instance, drilling equipment barely lasts three years. As a result, the overall depreciation charged to production tends to be understated, thus leading to an understatement of COMIBOL’s losses and overstatement of its profits.47

We may conclude that without the reduction and cancellation of taxes, the termination of compensation payments, and other governmental support during these years, COMIBOL’s costs would have risen substantially and no profits–however calculated–would have been realized. In short, the Triangular Plan’s $62 million of financial assistance alone did not move COMIBOL from bankruptcy to solvency.

Mineral Prices and COMIBOL Revenue

A complete picture of the Corporation’s financial performance, moreover, requires a consideration of the revenue side of the profit and loss equation. In marked contrast to the pre-Triangular era of decreasing prices, the Plan benefited from higher world mineral prices. The price of tin increased from $1.01 a fine pound to $1.68 from 1960 to 1970; the price of copper from $.28 to $.64; the price of bismuth from $1.45 to $5.83; the price of wolfram increased by over 300 percent; and no major mineral produced by COMIBOL sold for less in 1970 than it did in 1960 (Appendix Table 4). These impersonal market allocations were less impressive than presidential decrees, less tangible than physical capital, and less diplomatic than international agreements. Yet they enhanced the production, revenue, and profitability of the Corporacion Minera de Bolivia at a most critical time in its history. It is reasonable to say that had mineral prices not increased during this time, the Triangular Plan would have been proclaimed by one and all a failure since no profits would have been earned by COMIBOL.

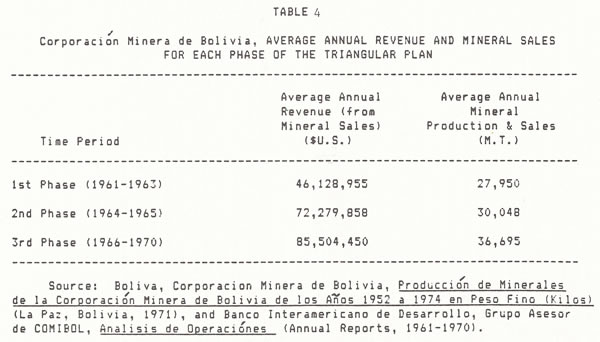

The world-wide inflation and higher mineral prices which prevailed throughout the 1960’s were a mixed blessing for both COMIBOL and Bolivia. The prices of many items imported during the first two phases of the operation, such as dynamite, protective rain clothing for miners, etc., increased by 20 to 30 percent.48 Moreover, the internal prices of Bolivia were not immune to the world-wide inflation. During the ten years of the Triangular Plan, the Bolivian price index rose by 47.3 percent.49 Nonetheless, the higher mineral prices which prevailed throughout the years of the Triangular Plan were beneficial to the Corporation. These higher prices, in conjunction with the Triangular Plan capital assistance and governmental support, stimulated exports. Greater sales at higher prices were the agents of greater revenue earnings. The firm was able to more than double its revenue earnings during the decade of the Triangular Plan due to both higher prices and increased sales. During each successive phase of the operation, COMIBOL’s total revenue increased. It should be noted, however, that the increase in value was much greater than the increase in volume, as seen in Table 4.

In conclusion, there were many complex and interrelated components which made up the COMIBOL profit and loss equation. It would be erroneous to report that the changes in profitability during the decade of the 1960’s stemmed solely from the Triangular Plan inputs. There would have been no profits, accounting or actual, without the lower taxes and higher mineral prices which prevailed throughout the decade of the 1960’s. Finally, COMIBOL’s improved financial performance, while substantial, nevertheless fell far short of expectations and potential. The Corporacion Minera de Bolivia survived the second decade of its existence and the Triangular Plan contributed to its salvation, but COMIBOL was not in the end rehabilitated. To see this clearly, the real variables which lie beneath the financial veil must be uncovered and examined. This is the task to which we now turn our attention.

IV

THE TRIANGULAR PLAN: COMIBOL TECHNICAL EFFICIENCY

In this section we shall attempt to determine the degree to which COMIBOL failed to improve its technological and economic efficiency (luring the Triangular Plan. Only through improved technological and economic efficiency could the Corporation hope to achieve long run, self-sufficient solvency and, hence, true rehabilitation. This is because so many of the factors responsible for COMIBOL’s profitability during the Triangular Plan such as tax subsidization, higher mineral prices and capital assistance could not he relied upon to prevail in the future. The reader will recall that the end product of technical inefficiency prior to the 1960’s was higher financial costs and economic losses.

Disinvestment in Exploration and Declining Ore Reserves

Immediately prior to the Triangular Plan, a geological report of COMIBOL claimed that “mineral reserves of the mines in operation in Bolivia are nearing exhaustion.50 The Huston Study also reported that only the three mines of Catavi, Huanuni, and Caracoles possessed sufficient ore reserves and thus the profit potential to repay the loans required for their rehabilitation. The remaining mines, recommended Huston, should either (1) shut down permanently, (2) shut down temporarily and do only exploration work, or (3) continue operating at a loss while carrying out extraordinary underground exploration.51

At first blush, spending large sums of money exploring these mines, many of which were more than half a century old, did not appear to be a sound investment. Exhaustion of ore and diminishing millheads grades are, after all, natural to mining properties. Upon closer examination, however, the extensive mineral holdings of the Corporation combined with a history of neglect rendered high the prospect of encountering additional high grade ore according to many geologists at the time. However, modern exploration work, such as geological studies (surface and air), geophysical testing, diamond drilling, and the like was very expensive. As the Ford, Bacon, and Davis engineers pointed out:

In spite of the declining condition of the tin industry at present, the prospects of increasing the commercial tin ore reserves of Bolivia are reasonably good. Development of these potential reserves will require substantial investments in exploration . . .52

During the decade of the Triangular Plan, the Corporacion Minera de Bolivia should have invested at least $35 million in exploration or five percent of gross revenue, a sum considered a minimal investment by mining experts. Fully cognizant of this industry-wide standard, the Triangular Plan advisors nevertheless allocated just $4 million to mineral exploration, representing only one half of one percent of COMIBOL’s total revenue and less than one tenth of what a comparable mining company typically invests in the area. These nominal expenditures for exploration, therefore, actually constituted net disinvestment, and the long history of ore decapitalization of the COMIBOL mines continued throughout the Triangular operation.

Under the special circumstances in which COMIBOL and the Bolivian economy encountered themselves in the early 1960’s, immediate investment of the $4 million in exploration at the functioning mines was imperative. Yet Prospection Ltd., the Canadian firm responsible for the exploration program during the first two phases of the Triangular Plan, spent $2 million on geological investigation of properties which were not then being mined.53 While such virgin exploration may have offered greater future returns, new mines would have required three to five years and millions of dollars of investment to be placed into operation. Both the time intervals and levels of funding were beyond COMIBOL’s abilities at the time. Such expenditures for exploration did little more in the short run than constitute a drain on the firm’s exceedingly limited financial resources.

Cognizant of this reality, the Corporation did terminate its contract with the Canadian firm in 1966. A new $2 million exploration plan for Phase Three was designed and approved by the U.S. Geological Survey.54 To staff six exploration teams, COMIBOL hired five foreign geologists and one geophysicist. Fifteen years after the revolution, Bolivia still did not have the human capital necessary for modern mineral exploitation. Thereafter, all exploration activities were directed to developing reserves at or near operating mines in an attempt to obtain quick financial returns. These efforts, however, were too little, too late, and too restricted.

Minimal and misplaced effort contributed to lower mineral reserves at the COMIBOL mines during the Triangular Plan years. Before 1963, the Corporation did not publicly report on mineral reserves other than tin. Since that date its records show that only copper and zinc reserves increased while those of all other minerals decreased.55 More significant was the decline in the tin ore reserves as seen in Figure 2 below.

These estimates, like the Corporation’s other statistics, must be handled with caution. They are highly speculative and vary in coverage, definition, and accuracy. Nonetheless, even such problematic statistics are revealing. For instance, potentially recoverable mineral from mill tailings and old fills were included in the official reserves after 1963.56 One gathers the impression from this that the firm was attempting to compensate for its declining reserves by redefining the term and changing the measurements. In mining, a mineral resource should not be classified as a reserve until there is evidence that its size and grade are sufficient for it to be economically produced. There is every indication that COMIBOI did not adhere to this criteria. Thomas F. Burke estimated that only 15 percent of the Corporation’s reserves were economically exploitable in 1965. Based upon this information and existing production rates, he concluded that the firm could only expect an operational life of 4.2 years.57 Interestingly enough, COMIBOL’s own estimate in 1970 did not anticipate a sufficient time period in which to repay the Triangular Plan loans.

There is only one conclusion to draw from this disinvestment in exploration and increasing production of shrinking reserves: both the Triangular Plan partners and the military governments of Bolivia had the implicit goal of constricting the size and influence of the Corporacion Minera de Bolivia. Their reasons for doing so are rather obvious. Bolivian Presidents Rene Barrientos Ortuno and Alfredo Ovando Candia had numerous political problems with COMIBOL and its union. These problems ultimately culminated in the infamous San Juan Massacre of the miners on June 23, 1965.58 To reduce COMIBOL was to simultaneously destroy their political and ideological opponents. These governments, like their MNR predecessors, also chose to pursue a policy of regional and economic diversification via the promotion of commercial agriculture, petroleum, and other non-traditional industries in the valleys and lowlands.59 In addition, the U.S. government, that of West Germany, and the Inter-American Development Bank did look with favor upon COMIBOL unions, revolutionary co-management, or the Corporation itself. They were, both in ideology and policy, committed to the furtherance of private enterprise in Bolivia and throughout the world.

However the political reality in post-revolutionary Bolivia was such that private mining and diversification could only be promoted in conjunction with support from the nationalized mines. The Triangular Plan was the mechanism whereby they could obliquely achieve these objectives by covertly and overtly constricting the size and influence of the Bolivian public mining corporation. Many of the reforms enacted during the Triangular Plan such as lower mining taxes actually benefited the private mines more than the public mines. Other actions such as the removal of COMIBOI’s mineral properties and disinvestment in exploration simultaneously shrank the Corporacion Minera de Bolivia and expanded the private mining sector.

Moreover, numerous COMIBOL mines were converted to cooperatives, closed down completely, or leased to private operators during the Triangular Plan. The most notable example of the latter was the leasing of the Matilde zinc-lead mine to the United States Steel Corporation for $13 million in 1966. The private mines clearly prospered from all this and in less than a decade they became the dominant sector in Bolivian mining. This partial denationalization of COMIBOL during the Triangular Plan is a major finding of this case study and will be analyzed in more detail later. Here it is introduced as an explanation of the logic behind an expenditure of only $4 million for mineral exploration during the Triangular Plan.

Grades of Ore and Recovery Rates

Another major variable adversely affected by disinvestment in exploration was millhead feed. The grade of ore mined and delivered to the concentration mills decreased from an average of .85 percent tin in 1960 to .76 percent in 1970 (Appendix Table 7). In an attempt to retard the decline in millhead feed, COMIBOL management increased production at those mines which possessed the highest grade veins and decreased production at all others. On the one hand, this policy had the desired effect of retarding the falling grade of ore delivered to the mills. On the other, however, this more rapid exploitation of the highest grade ores contributed to an exhaustion of mineral reserves and hastened the rate of decline in millhead grades.

The Corporation attempted to technically compensate for the declining millhead grades in yet another way: by greater recuperation of mineral at the concentration mills. Mineral recovery rates at the COMIBOL mills increased from 52 percent in 1960 to 63 percent in 1970 (Appendix Table 8). The percentage gain in the recovery of mineral at the mills during the decade of the 1960’s was nearly double the percentage loss in millhead grade. Forty-four hundreths of one percent of tin (.85 [millhead grade] x .52 [recovery rate]) was obtained from every ton of ore mined in 1960. Ten years later, this figure had risen to .48 percent (.76 x .63). Had the average grade of ore mined not decreased during this period, mill recovery would have been even higher, and the Corporation would have been able to recover a much greater percentage of the tin. As Thomas Burke pointed out:

Once the grade of millfeed drops below 1 percent, recoveries decline rather rapidly, whereas above 1 percent, recoveries of 70 percent are common. In short, the problem is that existing technical equipment and methods formerly found effective for meeting the problem are currently inadequate, and, as such, the problem ultimately rests on the grade of ore being mined.60

Due to the poor grade of millfeed, the concentrates often did not meet minimum smelter specifications. The mineral, therefore, had to be reprocessed until such time that these minimum standards were achieved. Hence, to the extent the COMIBOL’s improved mill recuperation during the 1960’s was obtained from a recycling of low grade concentrates, it cannot be interpreted as an overall increase in technical efficiency.

It is clear that the available data reveal a mixed technical performance in mining and milling at COMIBOL during the years 1960-1970. The firm’s technical efficiency in the aggregate was slightly improved during the Triangular Plan. The $12 million of equipment, material, and spare parts imported during Phase I can be credited for much of this success. The Corporation installed separation tables, desliming cyclones, and new diesel power units as well as restocked the warehouses during this period. These capital imports enabled the engineers to modify, remodel, and renovate all the concentration mills. Deficiencies of equipment and parts at the mines apparently no longer existed by 1964 according to the Agency for International Development:

The recent visit to all the operating divisions of COMIBOL clearly established that materials and equipment are now in an acceptable normal range of daily consumption and is fairly well organized. Certain items required for authorization expansion and replacement programs are still on order. However, absolutely no serious or production-limiting shortages were found to exist.61

Prior to the Triangular Plan, all the technical variables–millheads, mill recuperation, and the grade of concentrates exported–had decreased. This greatly simplified the economic analysis inasmuch as all three unambiguously contributed to rising costs of production. The mixed technical performance of COMIBOL during the Triangular Plan complicates the economic analysis in a number of ways. The increase in mill recuperation more than offset the decrease in millhead grade. On the other hand, most of the depreciation and interest costs associated with the $18 million spent on equipment, material, and spare parts increased the cost of production (Appendix Table 3). Given the latter costs it seems reasonable to conclude that no significant cost reductions resulted from the modest increases in technical efficiency at the concentration mills during the ten years of the Triangular Plan.

New Technologies

Many Bolivian mining engineers placed enormous faith in technology to solve their many problems. Metallurgical research and experimentation in Bolivia was concentrated in flotation, volatilization, and smeltering. Flotation is a chemical process that follows mill concentration in order to treat the slimes and mill tailings which contain the unrecovered tin initially mined (approximately 50 percent). Volatilization is an intermediate smelting technique capable of upgrading tin concentrates from as low as 3 percent to 10 percent. As such, both techniques were appropriately designed to deal with Bolivia’s increasingly complex and lower grade tin ore. It was estimated, at the time, that each additional percentage recovery of tin increased COMIBOL’s revenue by $1 million. Needless to say, great expectations accompanied these new techniques that were theoretically capable of recovering 90 percent of the tin ore mined. Metallurgical research on such methods typically has a long gestation period before it yields financial returns. During the Triangular Plan, the only flotation plant in Bolivia was the one at Catavi formerly owned by the private American company, International Metal Processing Corporation (I.M.P.C.), and later jointly owned with COMIBOL. This impressive installation, valued at over $2 million, failed to earn a profit after nearly a decade of operation–or more correctly, experimentation.

Not until late in the rehabilitation program did two small smelting plants, Ex-Metabol and Ex-Funestano, experiment with the volatilization of low grade tin concentrates. Ex-Funestano was first leased to Tihua Mines Ltd for volatilization of low grade (3 percent) ore in l967.The commercial success of this operation led to the creation of the public corporation Empresa Metalurgia Oruro and the leasing of both plants to COMIBOL in 1968. In spite of a shortage of tin concentrates delivered to the plant, and personnel and other problems, the volatilization plants did achieve a degree of technical success. Average tin recovery at the two plants increased from 70 percent in 1968 to 78 percent in 1970.62 In the last year of the Triangular Plan, 10,402 metric tons of low grade tin concentrate averaging 9.5 percent were volatilized yielding 985 fine metric tons of commercial tin concentrates. Volatilization, nevertheless, did not contribute directly to the profitability of the Corporation during these years of operation inasmuch as the Empresa Metalurgia Oruro lost over $100,000 during each and every year of operation.63

Volatilization did increase the commercial reserves and concentrates of tin, and thereby rendered feasible a final stage Bolivian tin smelter.64 The creation of such a smelter would have given Bolivia the basis for a vertical integration of the industry.65 The Ford, Bacon, and Davis report had recommended that Bolivia encourage a private company to invest in a 10,000 ton capacity tin smelter.66 A smelter would make the mining of lower grade ores economical, increase the life of the mines, and contribute to an increase in the recovery of tin by an estimated 10 to 15 percent. A smelter would also lower preconcentration, transportation, and similar costs. Finally, a smelter would also give rise to a number of forward and backward linkage industries.

Despite such potential benefits, most reports on mining advised against the construction of a Bolivian smelter. In a later report, even the Ford, Bacon, and Davis Associates reversed themselves and recommended against a tin smelter on the grounds that the country lacked adequate reserves.67 In this they were supported by the Huston study which concluded that “it is our opinion that a tin smelter to treat all or part of the total production of Bolivian concentrates is not now technically feasible nor profitable.”68 The U .S. Agency for International Development was also opposed to the construction of smelters in Bolivia.

In 1963, a defiant Bolivian government established the Corporacion Nacional de Fundiciones (National Smelting Corporation) by Supreme Decree No. 06504 to administer all existing state owned smelters and to study plans for additional projects.69 In 1966, an agreement was reached with the firm, Klockner Humboldt Deutz, to construct a tin smelter at Vinto, Oruo, with an initial capacity of 7,500 metric tons of fine tin. Work on the project began in April, 1968; the first testing of the furnaces was carried out in late l970.70

Advanced technology and vertical integration did indeed hold promise for the long run rehabilitation and profitability of COMIBOL. Nonetheless it must be pointed out that each and every one of these metallurgical pilot projects raised rather than lowered the firm’s cost of production during the Triangular Plan. Moreover, when these new technological innovations began to benefit COMIBOL, little of the credit can be attributed to the Triangular Plan which neither financed nor promoted them. Less than $1 million of the Triangular Plan loans was spent on metallurgical research and experimentation, an amount inadequate for even one small flotation or volatilization project.

In conclusion, COMIBOL’s technical performance was only slightly improved during the 1960’s. On the one hand, there was an unambiguous increase in the recuperation of mineral at the concentration mills which can be directly attributed to the program. On the the other hand, the disinvestment in exploration was clearly the root cause of the declining grade of millhead feed. In the short run, the increased depletion of shrinking reserves enabled the firm to increase its production of mineral and to realize accounting as well as actual profits. In the long run, the failure of the Triangular Plan to invest in exploration and new technology only hastened the demise of the Corporacion Minera de Bolivia. As such, the Triangular Plan may be said to have salvaged the Corporation at the expense of true rehabilitation. Beyond this, the Plan did not restore the Corporation to its “former capacity” or make it a major source of “livelihood” for Bolivia’s miners.

V

THE TRIANGULAR PLAN: COMIBOL LABOR AND ECONOMIC EFFICIENCY

Either erroneous economic thinking, ideological bias, or both, misled the Bolivians and foreign advisors responsible for the Triangular Plan to conclude that labor was the major factor responsible for the inefficiency and unprofitability of the Corporacion Minera de Bolivia. Consequently, inappropriate labor policies were implemented to achieve incorrect objectives, and the end result was again the failure to rehabilitate the Corporation.

Labor Force Reduction Program

Before the operation began, COMIBOL’s labor force numbered 28,927 of which only 9,477 were engaged in extracting ore beneath the earth (Appendix Table 6). The average productivity of labor was less than one half of a fine metric ton of tin per year and wages plus salaries constituted nearly 60 percent of mine costs (Appendix Table 3). Beyond this, the labor unions participated in the management decisions of the Corporation. Compared with other mining operations throughout the world, COMIBOL’s above ground workers were excessive, labor productivity was lower, the unions were more powerful, and labor costs as a proportion of total costs were higher. From this, it is easy to see how the AID technicians, Huston engineers, and Corporation managers could conclude that labor was primarily responsible for the firm’s poor economic performance. However, when they boldly asserted that “labor anarchy was ruining the mines,71 they went too far. We have already seen how the world tin market, the governments of Bolivia, the former private mine owners, and the managers were also responsible for the poor performance of COMIBOL. When they argued that “the only way to decrease labor cost (the one that has the highest incidence in the cost of production) is by reducing the labor force,”72 they were mistaken. Increased productivity via capitalization of the mines and mills was clearly an alternative way to achieve lower per unit labor costs. Lower money wages was yet another means to achieve the same end. We have seen that inflation during the 1950’s reduced the real wages of the miners.

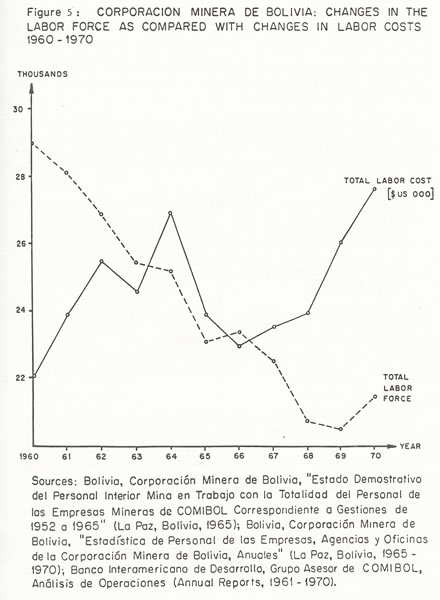

Because there was virtual consensus among all parties–even the labor unions concurred–that COMIBOL’s labor force was bloated and had to be reduced, the Triangular Plan provided $8 million for a mammoth layoff program The task required ten years and the labor force was reduced by only one-fourth. However, labor costs did not decrease.

The layoff program was an excessively expensive one inasmuch as each laborer reduced in force cost more than $1,000–a sum exceeding the average annual wage of a miner. The exorbitant cost of the labor force reduction is partially explained by Bolivian Labor Law which required that every worker dismissed be compensated with one month’s wage plus an additional month’s wage for each year of employment. However, this alone fails to fully account for the high financial cost of the program. For example, the work-life of a COMIBOL mine employee did not exceed ten years and the average monthly wage during January-April 1965 (a record high for the Triangular Plan years) was only $65.73Thus, the $1,000 average cost of reducing one worker was obviously greater than the average compensation received by those laid off–many of whom received nothing.

Not surprisingly, only those miners with longevity as well as those engaged in the more arduous tasks took advantage of the program at first. Over 1,750 interior laborers exercised their layoff option during the first two years of the program. Alarmed, the Bolivian government in early 1963 ordered layoffs of exterior workers only. The unions protested, the government arrested a number of labor leaders, and the miners seized seventeen hostages in retaliation–among them three United States citizens. The troops were sent to the mines and a major confrontation was only averted when the miners capitulated to the government’s demands. The workers’ control groups were subsequently suspended in August of 1963, and over the next two years, 3,000 surface workers “voluntarily” retired from the mines.

Military Intervention in the Mines