The Internship experience that inspires research, professional growth, and a deeper appreciation for preservation.

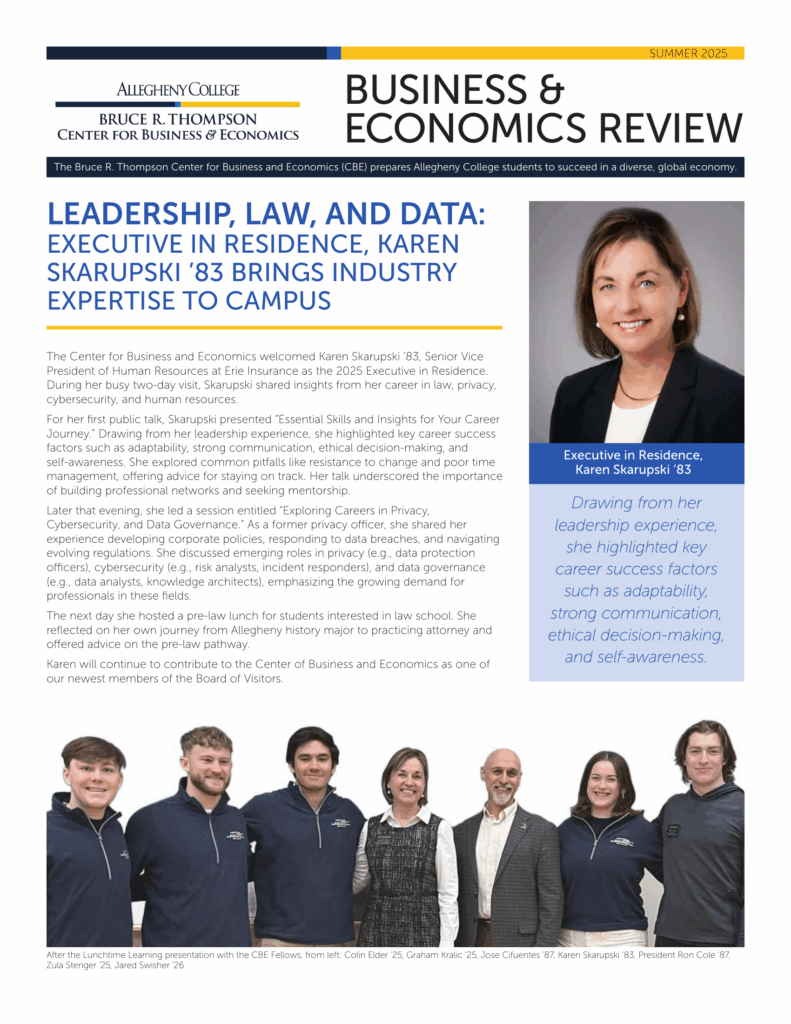

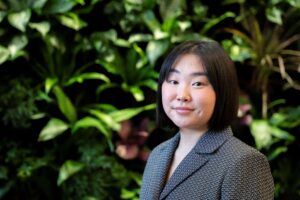

Logan Lee ′26, a Business major and Communications & Media minor, spent an unforgettable summer at Gettysburg—the site where President Abraham Lincoln delivered his iconic Gettysburg Address. Through the Higher Ground Leadership Experience, Logan combined his academic interests with hands-on leadership development.

As part of his internship, Logan authored “The Economic Ramifications of the Gettysburg Battle,” published in the December 2025 edition of Preservation & Progress, a Gettysburg Foundation publication. His research revealed the staggering economic toll on local citizens, who filed hundreds of damage claims for livestock, crops, tools, clothing, and homes. Logan writes, “As the smoke cleared on Independence Day in 1863, Gettysburg faced an uphill battle to reach normalcy, reconciliation and peace.”

Carol Reardon ′74, Adjunct Professor of Civil War Era Studies at Gettysburg College commented, “During a quiet period for the Higher Ground Leadership Program that Logan helped to run this summer, the Gettysburg Foundation’s senior leadership challenged him to apply his economics and communication interests and skills to produce this [article]. Looks like he’s developing some history vibes, too!”

Logan Reflects on His Experience

What inspired you to apply for the Gettysburg internship?

“I was encouraged by Professor Ishita Roy, who believed the program would be an excellent fit for me, and a valuable step in my professional growth. Their confidence in my potential really motivated me to apply, and I’m incredibly grateful that I did.”

What surprised you the most about spending the summer in Gettysburg?

“Honestly, looking back, the biggest surprise was the abundance of deeply passionate individuals who both work and live in Gettysburg. Their dedication to preservation, education, and public history was inspiring. Being surrounded by people who truly embodied the idea of ‘never working a day in your life’ because they love what they do made a lasting impact on me”

Would you recommend the internship to other Allegheny students?

“Definitely, my summer in Gettysburg helped me grow both professionally and personally. The combination of meaningful work, mentorship, and the historical environment shaped my skills, confidence, and long-term career interests. I would strongly recommend this internship to my fellow peers.”

About the High Ground Leadership Experience @Gettysburg

The Higher Ground Leadership Experience, offered by the Gettysburg Foundation, transforms historic lessons into modern leadership strategies. Through legacies from the Civil War, participants discover enduring lessons in leading under pressure, navigating change, aligning missions, and turning historical insight into actionable leadership strategies.