Available below for your convenience is information and/or links to downloadable forms related to medical benefits, disability, life insurance, domestic partner benefits, retirement, flexible spending accounts and HSA.

[/accordion]

Effective date: First day of month after hire date

Carrier: Highmark

- Medical Plan – Highmark QHDHP

- Spring Health

- Sempre Health Program

- Additional Resources

Effective date: First day of month after hire date. Only employees with a hire date prior to 9/1/2019

Carrier: Highmark

- Medical Plan – Highmark PPO

- Spring Health

- Sempre Health Program

- FSA/Section 125 Plan

- Additional Resources

Effective date: First day of month after hire date

Carrier: Lincoln Dental

The dental programs are voluntary, and the employee pays the full premium for coverage.

- Dental Plan – Lincoln Dental Connect –

ID Card can be downloaded from your account

Effective date: First day of month after hire date

Carrier: VBA

The vision program is voluntary, and the employee pays the full premium for coverage.

- Vision Plan – VBA

Effective date: First day of month after hire date

Carrier: Aflac

The Aflac program is voluntary, and the employee pays the full premium for coverage.

- Aflac –

- Aflac

- Alynn Cervone, District Sales Coordinator 724-494-2667

Effective date: Coming Soon – Fall 2025!

Carrier: IdentityForce

With the increased volume and velocity of data breaches, including

personal information being sold on the dark web, IdentityForce takes

protecting identities seriously.

This program is voluntary, and the employee pays the full premium for coverage.

- IdentityForce

Effective date: Coming Soon – Fall 2025!

Carrier: LegalEASE

With the LegalEASE Plan, you’re covered when you run into life’s challenges with paid in full

benefits for personal legal matters. LegalEASE has the largest and most highly qualified

Attorney Provider Network, with attorneys in all 50 states focusing in over 60 areas of law.

We’ve got you covered no matter your situation or location.

This program is voluntary, and the employee pays the full premium for coverage.

- LegalEASE

AblePay, a unique, NO-COST, program that provides savings and flexible payment terms on out-of-pocket medical expenses. You simply sign-up for the AblePay program and use your AblePay card when seeking medical services with select providers.

What AblePay offers participants:

- Savings – Members save up to 13% on medical expenses not covered by their health insurance plan (deductibles, copays, coinsurance, etc.)

- Flexibility – Everyone has different needs, therefore AblePay has flexible payment terms options

- Convenience – Bills can be stored in your AblePay portal for direct payment at the click of a button

- Advocacy – Experts available to help with billing questions or payment prior to or after medical care

Who can participate in AblePay:

- This program is available to all staff and faculty, both full-time and part-time

- You can enroll if you have the College’s health plan or a plan outside of the College

- If you have our insurance but your family members are on a different plan, you can add them to your AblePay account

How to Enroll:

- Visit the AblePay Site with this link and click “Continue” in Step 1. Welcome. Follow the prompts through each step

- Enter “Allegheny College” under employment (in Step 3 Primary Member)

- Add additional members that you’ll be responsible for (they can have a different insurance plan)

- Add your default payment term and payment method(s)

- Receive your AblePay card in the mail and keep with insurance card

Payment Terms and Savings:

| Payment Terms | Bank ACH | Card |

| 1 Pay | 13% | 10% |

| 3 Pays | 10% | 7% |

| 6 Pays | 8% | 5% |

| 12-24 months | No Saving/No Interest | No Saving/No Interest |

How AblePay Saves You Money:

For example, if you have a $1,000 medical bill at Meadville Medical Center or Titusville Area Hospital (both participating providers), you would pay AblePay $870, saving $130. AblePay offers discounts on medical expenses and gives you payment plan options without interest or fees. Meanwhile, the full $1,000 counts toward your deductible and is credited to the provider. You can also link an HSA card as a payment method in AblePay to maximize your savings.

Learn more:

test

Effective date: First day of month after hire date

Carrier: Highmark and Spring Health

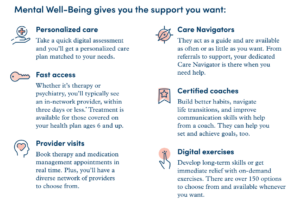

The right mental health care starts right here.

Simple and easy access to care is what Mental Well-Being powered by Spring Health is all about. This program can help you get the right care, right when you need it.

Spring Health is a holistic approach to managing mental health. Members are assessed across 10+ behavioral health conditions and have access to:

- Digital content and cognitive behavioral therapy

- Care navigation

- Coaching

- Expanded access for therapy and medication management

- Support for children 6+ and caregivers

- Personalized provider matching; on-demand scheduling based on member preference

- Shorter wait times

- Right care, right time

Already have an online account? You can log in using your existing Highmark username and password.

Download the My Highmark app from your phone’s app store or visit MyHighmark.page.link/MentalWellBeing today.

Effective date: First day of month after hire date

Carrier: Highmark and Sempre Health

HIGHMARK AND SEMPRE HEALTH TAKE CARE OF IT FOR YOU.

Highmark and Sempre Health want to help engage your members while reducing your company’s total medical and pharmacy benefit costs. The Sempre Health program offers your members manufacturer discounts* on their prescriptions in order to help improve medication adherence.

It’s simple. Members who are on applicable prescription medications for certain chronic diseases can opt in to receive text messages offering medication reminders and discounts through Sempre Health. Then they’re rewarded with a discount if they pick up their medications on time. This can lead to healthier, more engaged members — and some serious cost savings on medical claims for your company.

- Discounts on their prescription copays by refilling consistently and on time.

- Monthly refill reminders help members stay adherent.

- Increased adherence means members may be less likely to have more serious health issues later.

- Not paying more than their standard cost share, although discounts can decrease if members don’t refill on time.

- Improves medication adherence by 15% to 19%** by reminding members to fill their prescriptions on time.

- Can save your company costs on medical claims by helping to keep members more adherent.

- Takes care of all of the relevant member communication directly, including enrollment, so you don’t have to print or send anything.

Effective date: July 1, 2002

Employees who elect not to participate in the Highmark Blue Cross/Blue Shield Medical Plan offered through Allegheny College will receive $19.23 per pay (bi-weekly) as an opt out benefit payment which will be treated as ordinary taxable income.

In order to be eligible for this benefit payment, proof of other coverage must be provided to the Office of Human Resources.

One of the following documents will satisfy as proof of coverage:

- a letter from the insurance carrier,

- a letter from the other employer, or

- a copy of the insurance card.

Nobody wants to imagine their pet getting sick or injured – but when it comes to your pet’s health, it’s best to expect the unexpected.

Wishbone is accepted at any vet in the U.S., including emergency hospitals. Our simple online claims process means you get your money back fast, whether it’s for routine care or an accident.

Protecting your pet’s health and your finances has never been easier!

Life Insurance and AD&D

Effective date: First day of month following six months of service;

Carrier: Lincoln Financial

Group term life insurance coverage is provided to all regular full-time employees of Allegheny College. The life insurance coverage is 1-1/2 times the employee’s annual base salary, subject to a maximum amount of insurance of $250,000. Life insurance coverage for the employee is provided at no cost to the employee. The amount of insurance coverage in excess of $50,000 is taxable to the employee pursuant to Federal tax law and will be added to taxable income.

- Faculty

- Non-Faculty

- Additional Resources

Supplemental Life Insurance

Effective date: First day of month after hire date

Carrier: Lincoln Financial

- Faculty

- Supplemental Term Life – Faculty

- Non-Faculty

- Supplemental Term Life – Non-faculty Employees

Short Term Disability Leave

Effective date: First day of month following six months of service;

Carrier: Self-funded. Administered by Lincoln Financial

Full-time employees who are medically disabled and unable to perform their duties due to a non-occupational illness or injury may be eligible for up to six months of paid leave and benefit subject to medical certification by a licensed physician. Allegheny College may require a second medical opinion at the College’s expense.

Employees with anticipated disabilities should promptly notify the Office of Human Resources to complete the necessary forms.

Long Term Disability

Effective date: First day of month following six months of service;

Carrier: Lincoln Financial

Full-time employees who are medically disabled and unable to perform their duties due to a non-occupational illness or injury may be eligible for up to six months of paid leave and benefit subject to medical certification by a licensed physician. Allegheny College may require a second medical opinion at the College’s expense.

Employees with anticipated disabilities should promptly notify the Office of Human Resources to complete the necessary forms.

- Faculty

- Non-Faculty

Child-bearing Disability Leave

Periods of disability related to pregnancy and/or childbirth are treated like any other disability. Generally, an employee who gives birth without complications would be eligible for six (6) weeks of paid disability leave and benefits under the College’s Short-term Disability Leave policy. Should medical complications arise before or after the birth, the employee would be eligible for additional paid leave beyond the six weeks, subject to medical certification by a licensed physician.

Faculty who give birth are also entitled to receive a three-course reduction in teaching responsibilities with no loss of pay or benefits. If the timing of disability requires that a faculty member take the three-course teaching reduction during that semester of disability, a complete reduction of duties (such as advising, departmental service, and committee work) will be granted to the faculty member for the entire semester.

If the three-course reduction is taken all at once and during the semester following birth, faculty have the option, wholly at their discretion, of extending complete reduction of duties for the entirety of the semester in which the course releases occur. This option will entail a commensurate reduction in salary of 20% for the semester (either from the September through February paychecks for the fall semester or from the January through August paychecks for the spring semester).

Faculty members who anticipate disability due to pregnancy should promptly notify the Provost and Department Chair of the anticipated disability date. A written plan for staffing the period of leave must be formulated in consultation with all three parties and approved by the Provost, and should be formulated and approved in advance of the semester in which the birth is anticipated to occur. The Office of the Provost shall maintain a file with these plans for reference and to ensure consistency over time.

All regular full-time employees who can satisfy the criteria for a domestic partner relationship are eligible to enroll their domestic partner and/or dependents in benefits to Allegheny employees. Eligible employees must provide the appropriate documentation to establish that a domestic partnership exists. Additional information can be obtained from the Office of Human Resources.

- Domestic Partner

- Domestic Partner Benefits Policy

- Affidavit of Marriage or Domestic Partnership (to apply for domestic partner insurance coverage)

- Declaration of Dependent Tax Status

- IRS Worksheet for Dependent Tax Status

- Affidavit of Termination of Domestic Partnership (to cancel existing domestic partner coverage)

Under the Allegheny College sponsored Tuition Benefit Program, two distinct approaches are taken to provide continued education for the College’s employees, spouses, domestic partners and dependent children: Tuition Remission (attendance at Allegheny College and branch campus ALIC @ Bessemer); and Tuition Exchange (attendance at other participating institutions).

Eligibility

Service

Coverage

Availability

Degrees

Attendance

Administration

Appeal

Eligibility

- Employee must be a regular, full-time employee of Allegheny College;

- Spouse must be married to a regular, full-time employee of Allegheny College;

- Partner must be in a committed relationship of at least one full year with a full-time regular employee and financially interdependent as defined in the Allegheny College Domestic Partner Benefits Policy;

- Dependent Child must be a dependent of a regular, full-time employee and be claimed as a dependent of the employee on his/her federal income tax statement for 3 consecutive years prior to application for tuition. Legal documentation showing that the employee is the custodial parent for at least 50% of the time for tuition is acceptable proof of dependency. Eligibility is limited up to the equivalent of eight (8) semesters of full-time undergraduate enrollment or up to the equivalent of eight (8) semesters of full-time graduate enrollment, or until completion of the degree, whichever comes first. The age limit for completion of benefits is 26 years of age.

Service

The length of service an employee has with the College affects the tuition eligibility for dependent children only.

Service requirements for Tuition Exchange and Tuition Remission are immediate eligibility for active employees; at least 6 years of service if employee is deceased; at least 10 years of service if employee is retired or disabled. See Section 500.8 of the Employee Handbook for retirement eligibility.

Employees hired before July 1, 1998, are eligible to apply for the tuition grant benefit; however, if the institution the student wants to attend participates in the tuition exchange program, application must be made through tuition exchange first, and only if the student is denied tuition exchange, will the employee be given the tuition grant benefit.

Coverage

All programs cover tuition payments only.

Availability

Tuition Remission and Tuition Exchange Programs are available for eligible dependent children, including courses at ALIC @ Bessemer. Employees, spouses, and partners may apply under the Tuition Remission Program only.

Degrees

- Dependent Child candidates must be accepted in a 2- or 4-year undergraduate degree program to be eligible for consideration under both tuition benefit programs. Only institutions issuing a diploma will be accepted. Certificate programs will not be considered. Courses taken at ALIC @ Bessemer are eligible for tuition benefits.

- Employee, Spouse, and Partner may be degree seeking or not, or already have a 4-year degree. If desiring credits for an undergraduate degree, the individual must be accepted as a viable student by the College. Courses taken at ALIC @ Bessemer are eligible.

Attendance

- Employee may only attend Allegheny or ALIC @ Bessemer on a part-time basis. Full time employees of Allegheny College may take up to 4 credits per semester or 8 credits per academic year tuition-free. Time spent in class must be made up without the charge of overtime.

- Spouse or Partner may attend Allegheny ALIC @ Bessemer on a full-time or part-time basis.

- Dependent Child may attend Allegheny ALIC @ Bessemer on a full-time or part-time basis; however, if participating in the Tuition Exchange Program, they must attend their chosen institution as a full-time student. Any credit bearing programs offered through Allegheny College at an additional tuition charge above the regular full-time tuition rate may be covered by the tuition remission benefit, but it will count as one of the eight semesters available for each student. Only one of these educational opportunities may be covered by the tuition remission benefit per student.

Administration

To apply for the Tuition Exchange Program, please create an application at https://telo.tuitionexchange.org/apply.cfm . Since the online application is limited to ten schools, if you have more than ten schools, please contact Natasha Eckart (neckart@allegheny.edu) with the extra schools and we will submit an application to them for you. To apply to the GLCA Tuition Remission Exchange, please fill out an application at https://glca.org/glcaprograms/tuition-remission-exchange and send it to Natasha Eckart. Tax returns from the previous three years are required for all programs, including Tuition Exchange and GLCA. Please submit the first page of your tax returns to Natasha Eckart. Applications for Tuition Remission and the Council of Independent Colleges’ Tuition Exchange Program are available in the Financial Aid Office. A list of participating institutions is provided at each program’s website. For an application or additional information, please call 814-332-2701.

A spouse, partner, or dependent student utilizing Tuition Remission must also complete the Free Application for Federal Student Aid (FAFSA) for each year they are receiving the benefit.

Appeal

Employees may appeal situations that do not exactly meet the criteria of these programs by submitting such circumstances in writing to the Allegheny Executive Committee (AEC).

Allegheny College reserves the right to amend, modify, interpret or discontinue all or part of this Policy at any time as it does with all College sponsored Plans and Policies.

Please visit our Retirement page

Allegheny College covers all employees with workers’ compensation insurance as a protection for illness or injuries arising out of, or in the course of, their employment, which are compensatory under the Pennsylvania Workers’ Compensation and Occupational Disease Act. Payment of workers’ compensation benefits are administered through CoordiNet.

All work-related accidents, including minor ones, must be reported immediately to the supervisor and to the Office of Human Resources. An accident report form, the Employee Injury Report form, must also be completed and submitted to the Office of Human Resources within 24 hours of the occurrence, even though there is no loss of time or medical attention. Failure to report a work-related injury in a timely fashion may jeopardize eligibility for payment of benefits for medical bills or lost time.

In accordance with the Pennsylvania Workers’ Compensation Act and to ensure that your medical treatment will be paid for by SISCO/RCM&D, you must select from one of the physicians or health care providers listed on the Panel of Providers.

- Employee Injury Report Form (to report an accident)

- Panel of Providers (for a list of area providers)

- Notice of Rights and Duties

- Workers’ Compensation Information

- Employee Family ID Request

- Employee Discounts

- Employee Assistance Program (EAP)

- Green Box

- Volunteer Time Off (VTO) Policy

Annual Privacy and Benefit Notices

-

- Highmark Notice of Privacy Practices

- Women’s Health and Cancer Rights Act Notice

- HIPAA Notice

- COBRA Continuation Coverage Rights

- USERRA Notice

- Employee Rights Under FMLA

- Drug Free Schools and Communities Act

- Medicaid and the Children’s Health Insurance Program (CHIP)

- Comprehensive Health Plan Disclosures and Notices

- Your Rights and Protections Against Surprise Medical Bills

- Summary Annual Report Notice

- 2025 Medicare Part D – Creditable Coverage Notice